How to handle backup withholding for your payees to avoid an IRS audit

“1% of payees trigger IRS backup withholding. Payment Labs automates tax checks & filings so you avoid audits, fines & penalties.”

99% of US taxpayers don’t need or even know about backup withholding because they fill out their W-9s accurately and pay taxes themselves.

But the remaining 1% leaves plenty of room for triggering an IRS audit and penalties for your business, unless you handle backup withholding correctly.

This overlooked IRS rule applies to all your W-9 contractors, prize winners, vendors, investors, athletes, creatives, and anybody else you pay and report via 1099 forms.

What is backup withholding and how it works

Backup withholding is a 24% flat tax that applies to payments you make to all people that you report with a 1099 or a W-2G form.

As a payor you start to withhold this tax once the IRS informs you that the payee is underreporting their income or provided you with an incorrect name or Taxpayer Identification Number (TIN). If the payee refuses or fails to provide a TIN, or you’re sure that it is incorrect, you may begin backup withholding immediately.

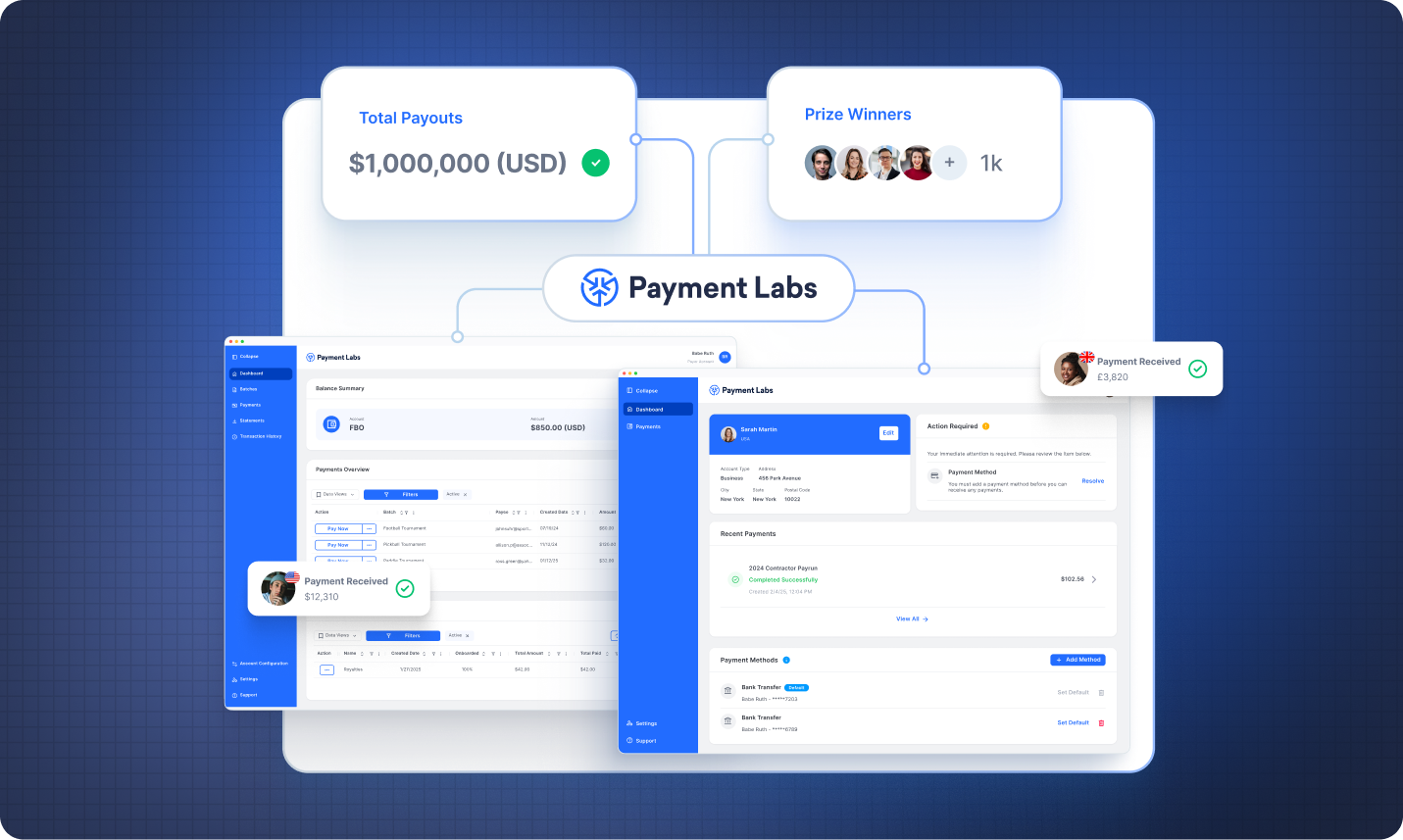

Payment Labs automatically determines if backup withholding applies to a payment and remits the tax to the IRS preventing any penalties, fines, or fees. We verify the TIN numbers when payees fill out their W-9s and prepare all necessary forms for year-end reporting.

The risks for your business if you fail to do backup withholding

Once the IRS has informed you about the payees who require backup withholding, your business runs the risk of getting in trouble with the agency unless you address it.

- Noncompliance is likely to trigger an IRS audit or review.

- If you continue to pay 100% to the payee, you still owe 24% to the IRS.

- Late deposits can lead to penalties of up to 15% and interest.

- There can be a fine of up to $660 per incorrect filing.

What triggers backup withholding for a payee

In general, payees take care of their taxes themselves. But there are a few cases when it’s up to the payor to withhold 24% of federal tax from all payments to a person and send it to the IRS.

- The payee provided you with an incorrect TIN or name.

- The payee indicated on a W-9 that they are subject to backup withholding.

- The payee didn’t provide you with a W-9 form at all.

- The IRS tells you to start backup withholding.

When you use Payment Labs as your payment provider for sports, esports, royalties, business services, or content creators, our platform checks whether each payee is subject to backup withholding and remits the tax to the Internal Revenue Service.

Two backup withholding programs and how to react to them

- B notice (CP2100 and CP2100A) – when your business receives the CP2100(A) notice, you have to notify the payee(s) to update their TIN and start withholding the tax for them no later than 30 business days after you receive the notice. If you have received two CP2100(A) notices for the same payee in less than 3 years, you will require TIN validation from the SSA or the IRS to stop backup withholding for that person.

- C notice – in case the payee fails to fully report on their federal income tax return, the IRS will contact them about it four times. If that doesn’t help, the IRS orders the payor to start withholding 24% from future payments.

For foreigners with W-8 forms, payors don’t follow the backup withholding procedure but have to withhold the tax using a different algorithm. Depending on the country and whether the US has a tax treaty with it, the tax rate can be up to 30% and is reported with forms 1042 and 1042-S.

How to report backup withholding

If the backup withholding is triggered for a payee, at the end of the year the payor reports withheld funds in the forms 1099 and 945 (Annual Return of Withheld Federal Income Tax). When payees file their tax returns, backup withholding that was already paid reduces their remaining federal income tax amount. If they overpay, they will get the excess money back in their annual refund.

A wide range of 1099-based payments can be subject to backup withholding – prizes, royalties, commissions, certain gambling winnings, patronage, payments from fishing boat operators, interest, dividends, government transfers, rent, and payments from brokers on securities transactions.

Make sure to consult your CPA on how these rules apply to your business and payees. You can also learn more about backup withholding, TIN numbers, application procedures, and relevant tax laws at irs.gov.

How to check if you have an accurate TIN

There are several types of TINs you may be working with.

- SSN – Social Security number

- EIN – Employer Identification Number

- ITIN – Individual Taxpayer Identification Number

- ATIN – Taxpayer Identification Number for Pending U.S. Adoptions

- PTIN – Preparer Taxpayer Identification Number

Payment Labs verifies the TIN numbers with the IRS in real time when the payees fill out the W-9 form.

How Payment Labs handles backup withholding

Backup withholding is one of those business tax rules you rarely talk or hear about. But mishandling any number of payees who are subject to withholding can turn into an IRS audit, business review, and costly penalties.

TIN matching, informing the recipients about correcting their details, withholding money, reporting it, and remitting it to the IRS is a lot of extra work to do. But with the right tools, these tasks get done automatically.

Payment Labs is built to solve all your payment management challenges with one flexible solution. Get in touch with our team to discuss how our platform can address all your payment needs including backup withholding, remittance, and reporting.