How to receive an international payment if my bank isn't connected to SWIFT

Receiving international payments is straightforward when both the sender’s and your bank are connected to the SWIFT network, a global messaging system used by over 11,000 banks. However, many smaller banks, fintechs, and regional institutions operate outside this network, which can complicate cross-border transfers.

If your bank isn’t connected to SWIFT, receiving money from abroad may involve higher fees, longer processing times, or failed transactions. But there are many reliable alternatives that allow international payments to reach you reliably.

Depending on where you and the sender are located, other payment rails may be more suitable. This guide explores the most practical ways to receive international payments without SWIFT and helps you determine the best option for your situation.

What is SWIFT and why is it so dominant?

SWIFT (the Society for Worldwide Interbank Financial Telecommunication) is a global messaging network that financial institutions use to securely exchange payment instructions and transaction data. Since 1973, SWIFT has enabled banks to communicate reliably without physically moving money across borders.

The network supports traditional wire transfers, fast, transparent cross-border payment services, and standardized global messaging formats. SWIFT’s dominance comes from its scale, standardization, and security. The network effect combined with regulatory trust, makes SWIFT the default infrastructure for international payments.

For more details, see our in-depth guide: All you need to know about SWIFT.

Why your bank might not be connected to SWIFT

Financial institutions outside the SWIFT network can still support international payments. Aside from sanctions, there are several reasons a financial institution might not be directly connected.

- High cost. SWIFT membership, infrastructure, and ongoing compliance are expensive, especially for smaller banks, fintechs, or regional institutions. Some organizations don’t handle enough international payments to justify the cost and overhead of a direct SWIFT connection.

- Strategic focus. Fintechs and digital banks often prioritize domestic payments, card networks, or other alternatives over traditional wire infrastructure.

- Operational complexity. Managing SWIFT payments is an ongoing operational overhead, not a one-time setup.

- Use of partner banks. Many financial institutions route international payments through SWIFT-enabled correspondent banks, outsourcing both the complexity and associated costs.

Practical SWIFT alternatives for receiving international payments

- Local payment networks (via virtual or local accounts)

Local payment networks move money within a region they cover, like SEPA in Europe, ACH in the U.S., or Faster Payments in the UK. International recipients can access these networks by using local or virtual bank account details from a payment provider or partner bank. The sender makes a domestic transfer using local details and the payment moves through the local clearing system, not through SWIFT. The provider then credits the recipient’s account in their preferred currency. This approach is common for recurring and business transactions.

For more details, see our in-depth guide: SWIFT vs local payment systems for cross-border payments.

- Fintech platforms

Fintech payment platforms like Wise, Payoneer, and Revolut connect multiple payment rails in one interface. They handle currency conversion and manage settlement on behalf of users. From the sender’s perspective, payments look like local transfers. These platforms simplify international money movement but may impose transaction limits or excessive fees, particularly for higher volumes.

- Card networks

Card networks like Visa or Mastercard enable cross-border payments by pushing funds directly to debit or prepaid cards. This method is widely used for marketplace payouts, gig-economy payments, refunds, and consumer disbursements. Card payouts are typically fast and available in many countries, but fees are higher than traditional bank transfers. They are less suitable for large or recurring payments and provide limited payment data information compared to bank-based methods.

- Correspondent banking via intermediaries

Even if a recipient's bank is not directly connected to SWIFT, international payments can be received through SWIFT-enabled correspondent or intermediary banks. In this model, the payment is routed through one or more partner banks to handle messaging, settlement, or currency conversion. While effective, this approach can result in slower processing times, higher costs, and limited visibility into intermediary fees.

- Cryptocurrencies

Cryptocurrencies can serve as an alternative settlement layer for international payments. Stablecoins are more commonly used than volatile cryptocurrencies to reduce exposure to price fluctuations. Funds are transferred between wallets, bypassing banking networks, and recipients typically convert the coins into their local currency. While fast and globally accessible, this method may involve additional steps for the recipient and introduces regulatory, compliance, and liquidity considerations.

How international payments work without or without SWIFT

International payments with SWIFT

- The sender initiates a transfer with their IBAN or account number, SWIFT/BIC code, beneficiary info, and the transfer amount.

- Payment instructions are sent via SWIFT.

- Settlement occurs directly or through correspondent banks.

- Funds typically arrive in the beneficiary’s account within 1-3 business days.

- The sender can track the payment and view fees, if their bank supports it.

International payments without SWIFT

- The sender initiates a transfer with an alternative method (digital wallet, multi-currency account, or local partner bank).

- The payment is routed through non-SWIFT infrastructure, like local payment networks, card networks, fintech platforms, or blockchain networks.

- The recipient receives payment in their local bank account, virtual account, wallet, or card, depending on the chosen used.

- Tracking and fee transparency depend on the provider and the payment method used.

How to choose the right option

When receiving international payments without SWIFT, the best method depends on transaction frequency, the countries and currencies involved, and the importance you put in speed, cost, and control.

Transaction volume and value

- Low value, occasional payments - fintech platforms or card payouts are often the simplest.

- High value, recurring payments - local payment networks via virtual accounts tend to be cheaper and more predictable.

- Very large transfers - correspondent banking may be necessary, even without direct SWIFT access.

Geographic corridors

- Same region - local payment networks often allow cross-border payments to be processed like domestic transfers if the sender and the recipient are within the same region.

- Between major markets - fintech platforms typically have optimized corridors with competitive rates.

- Less common country pairs - correspondent banking or cryptocurrencies may be required.

Speed requirements

- Immediate or same-day transfers - card networks or certain fintechs offer near-instant settlement.

- Standard timing (1-3 days) - local payment networks or correspondent banking work well.

Transaction costs

- Cost-sensitive - local payment networks often have the lowest fees within supported regions.

- Moderate fees - fintech platforms tend to balance convenience with reasonable pricing.

- High cost tolerance - card payouts and correspondent banking generally involve higher fees but offer wider reach.

Regulatory and compliance needs

- Highly regulated industries - correspondent banking provides traditional audit trails and full compliance documentation.

- Standard business payments - fintech platforms and local networks offer sufficient reporting and compliance.

- Minimal regulatory requirements - cryptocurrencies can work, but careful attention to local regulations is necessary.

The bottom line

Not being connected to SWIFT doesn’t prevent you from receiving international payments, you just need the right alternative. For most businesses and individuals, fintech platforms or local payment networks via virtual accounts provide the best balance of cost, speed, and reliability.

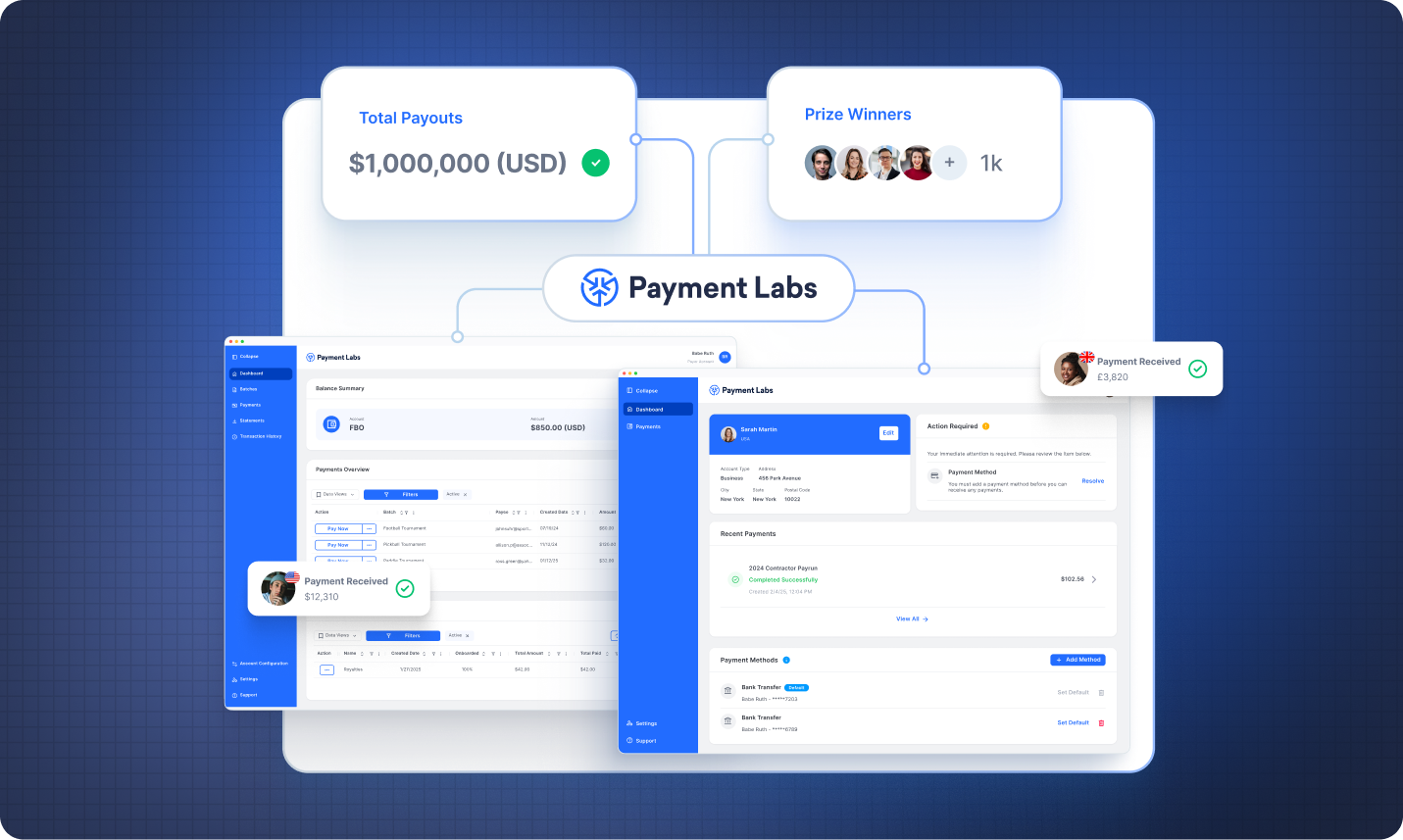

For organizations making global payouts at scale, Payment Labs specializes in high-volume international payments for sports, esports, creator economy, and businesses with hundreds or thousands of international payees. Our platform supports payments in 150+ currencies across 180+ countries, automating tax compliance, KYC/AML verification, and regulatory reporting. Whether you’re paying tournament winners, creators, freelancers, or contractors, Payment Labs delivers fast, secure payouts and fully compliant payments worldwide.