How money moves through the U.S. payment rails and how FBO accounts speed transactions up

Sometimes business payments show up in the payee account almost instantly. Other times, it takes both you and the payee days or even weeks of frustrating financial limbo, with no idea where your transaction got stuck. It may feel like a lottery, but it isn’t.

How fast a payment is delivered depends on all the participants in the transaction, their operating hours, batch processing windows, number of intermediaries, fraud checks, compliance processes, and whether or not an FBO account is used.

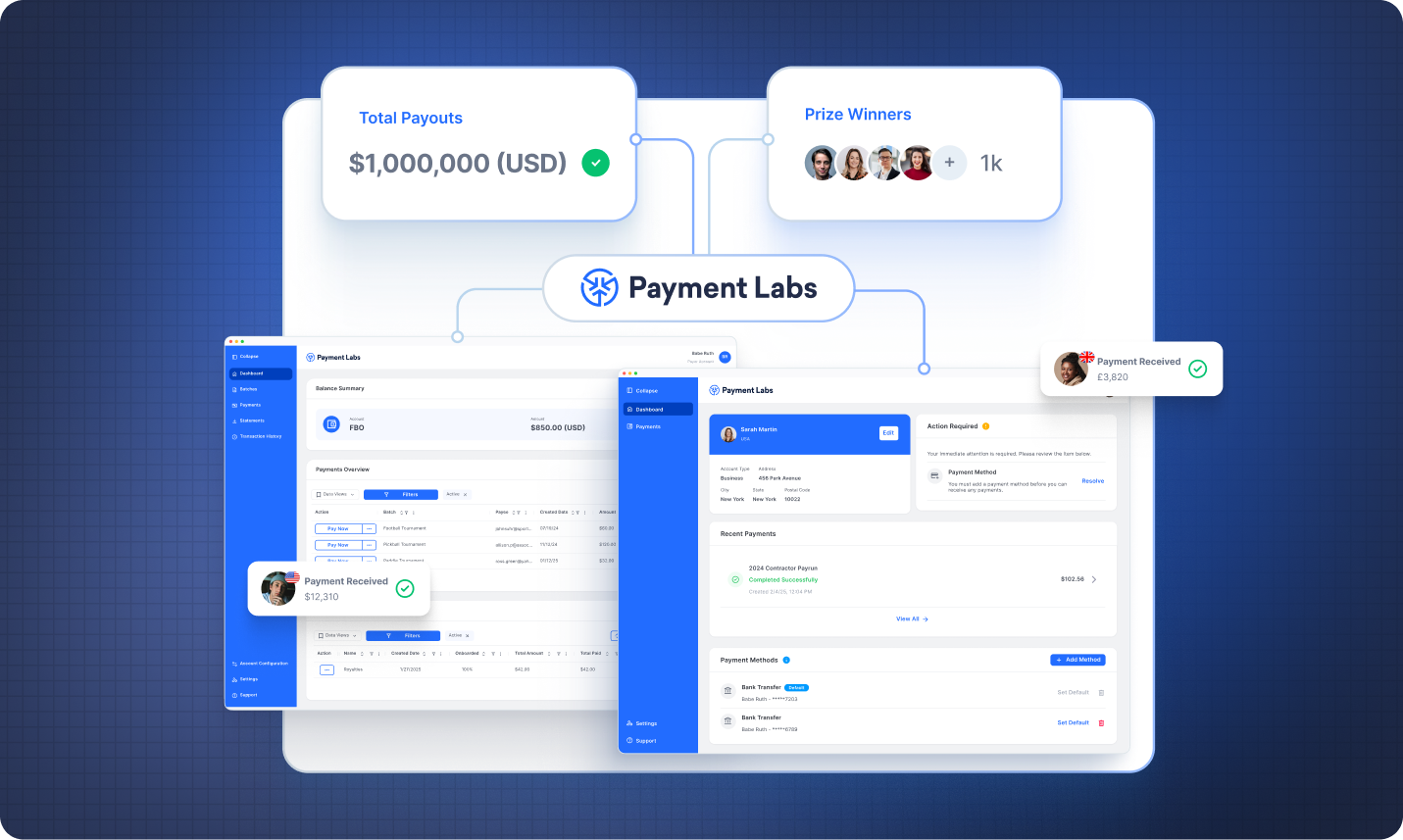

By the time your bank clears compliance and releases the wire, they might miss that day’s payment processing cutoffs. Once they do process the transaction the following day, you face more delays during the rest of the transaction’s lifecycle. To avoid depending on a chain of intermediaries, Payment Labs provides businesses with an infrastructure that delivers funds to payees anywhere in the world in a matter of seconds.

Let’s break down the parts of the process and how you can make sure your payments are delivered fast, at a fair price, securely, and compliantly so you can consistently surprise your payees with speed and reliability.

How a payment moves from a business to an individual in the U.S.

When your business sends money to a freelancer, creator, athlete, or contractor, the transaction passes through several participants before it is settled in the payee’s account.

- ODFI (Originating Depository Financial Institution) - originating bank receives payment instructions, performs compliance, fraud and risk checks, prepares the payment message in the correct format for the chosen payment rail, forms payment batches, and updates its ledger.

- Payment network - money moves between financial institutions via payment rails. It is their responsibility to deliver payment instructions to the receiving bank, validate transaction data, coordinate settlement, and update network records to show when a payment is pending, cleared, or settled.

- RDFI (Receiving Depository Financial Institution) - the receiving bank or other financial institution performs its own AML, KYC, and fraud checks on incoming funds, credits the payee’s account, updates its records, reconciles the payment with the originating bank and the network. RDFI may hold funds for risk review, or release them to the payee without further delays.

The five steps in the life of a business-to-person payment

- Initiation - payer authorizes a transaction and their payment processor or bank conducts AML, fraud, balance, and risk review.

- Transmission - payment processor or originating financial institution formats and transmits payment to the clearing or settlement system - ACH, CHIPS, FedNow, Fedwire, RTP, Visa, Mastercard, etc.

- Clearing - the payment network or other intermediary system validates the transaction data and prepares it for settlement. Some rails will clear payments almost in real time, and others form large batches of transactions to save costs.

- Settlement - money officially moves from the sender’s to the payee’s account, and the ownership of funds changes.

- Reconciliation - financial institutions update their records to match the transaction and ensure their ledgers align with the clearing and settlement data.

The main U.S. payment rails and transaction processing times

Every payment is subject to KYC, AML, and risk checks. However, some payment rails do real-time transactions nonetheless. They process messages, conduct necessary checks in milliseconds, do screening in advance, and allow updating ledgers first and do the actual interbank settlement later. Here’s a breakdown of the payment timings of each of the key payment rails in the U.S.

- ACH (Automated Clearing House) - operated by the Federal Reserve and a consortium of the largest U.S. banks. ACH does next-day and same-day delivery with batch-based electronic transfers within three daily windows, not real-time. They do not process payments on weekends or federal holidays. ACH is commonly used for payroll, bills, B2B transfers, direct payments. Same-day ACH payments are delivered within one of three windows on business days.

- Submit before 10:30 a.m. for delivery before 1:00 p.m.

- Submit before 2:45 p.m. for delivery before 5 p.m.

- Submit before 4:45 p.m. for delivery before the end of the business day.

- Real-Time Payments (RTP) - owned by major U.S. banks through The Clearing House (TCH) and allows for settlement in real-time (within seconds), 24/7/365. Moves money instantly between the participating banks’ master accounts in the TCH.

- Fedwire - used for large, time-critical payments. The network is operated by the Federal Reserve and offers real-time gross settlement.

- CHIPS (Clearing House Interbank Payment System) - this is a private large-value payment system for same-day settlement. It is well-suited for interbank settlements or cross-border payments in USD and is more cost-effective than Fedwire for high-value transactions.

- FedNow - operated by the Federal Reserve and used for instant payments 24/7/365, alternative to the privately-held RTP, which includes community and regional banks and enables real-time transfers.

- Card networks - different card networks are operated by companies like Visa, Mastercard, American Express, or Discover. Cards usually take 1-3 days to settle transactions in batches.

- Alternative rails - networks like Zelle enable direct bank-to-bank transfers, tools like Venmo and PayPal settle via ACH or cards. And cryptocurrency operates outside the conventional bank rails but still interacts with ACH or wire transfers.

Understanding FBO accounts and how they affect payment timings

A For Benefit Of (FBO) account is a single master account controlled by a payment provider. Inside it, there are subaccounts for each client and beneficiary, making sure the funds do not get mixed up.

These subaccounts are prefunded, which allows the provider to settle payments between them instantly. If a payment is made to someone outside the FBO, the transfer goes through the payment rail and the receiving bank’s checks. This structure allows bypassing the time payor’s bank takes to release the funds.

When using FBO accounts, the payment processor settles the payment as soon as the payor initiates it and takes the risk of waiting for the payment from the originator to be processed and delivered. Unlike systems where funds must first arrive from the payor before being credited, FBO accounts are prefunded, making money ready to move as soon as the payment is initiated.

For payment processors, digital wallets, lending platforms, gig-work platforms, and other providers, FBO accounts offer a way to manage thousands of clients from a single master account, simplifying reporting, accounting, reconciliation, and financial regulations. Each FBO subaccount is tied to a client’s identity, making AML and KYC compliance straightforward for each transaction.

Instant business payments takeaways

Clicking a button in your banking dashboard doesn’t necessarily make the transaction instantly leave your bank and go to the payee’s account. Compliance is unavoidable so most payments fully depend on the bank’s speed and their payment rail choice. But it is possible to ensure your business payments are delivered instantly.

For that, you need a payment provider that leverages prefunded FBO accounts and one that uses payment rails that support real-time transactions. If both your business and payee have FBO subaccounts with your payment provider, your payments can be quick, safe, and low-cost.

Powering instant business payments with Payment Labs

Payment Labs is built to meet non-standard payment needs and allows any business to get money out quickly. By combining prefunded FBO accounts with intelligent payment routing, Payment Labs ensures payments move at the pace you need, while staying cost-effective and managing tax compliance. Our platform handles the complexity of settlement, risk, and regulatory checks behind the scenes to make immediate and safe funds delivery effortless for the business.