The Payment Labs Story: A More Efficient Way to Pay People

Han Park is an LA-based entrepreneur and investor tackling the global issue that paying people is harder than it should be.

Han Park is an LA-based entrepreneur and investor tackling the global issue that paying people is harder than it should be, especially if you factor in all the regulatory, financial, tax, and different methods of payment requirements. Han’s mission and why he started Payment Labs is to make global payments simple and enable any business to pay anyone, anywhere in the world.

Let’s visit Han’s world and understand where his drive to solve this massive global problem started. This isn’t Han’s first rodeo with starting a business, and he knows how to do it successfully. Han was President of Turtle Entertainment America, a subsidiary of ESL Gaming – the world’s largest esports company, having sold for over $1 billion in 2022. He is also an active angel investor working with a number of startups that are looking to disrupt, innovate, and/or modernize the gaming industry, particularly in esports.

Han and his partners took on the concept of building an industry out of competitive video gaming, which today is known as esports. They helped create an entire industry: the rise of esports and how the global gaming mammoths can hold tournaments at scale today that draw massive viewership and fan engagement. Through this process, they had to pay out big volumes of prize money payments to gamers worldwide, so they learned about the pain points in global payments and what kind of platform needed to be built to solve the problems. It is estimated that prize money from gaming competitions would exceed $500M in 2023.

These events and Han’s 25-year expertise in building up this industry laid the groundwork for the why behind Han’s payment platform as he saw firsthand at scale the inefficiencies that can arise when esports tournament organizers have to make global payments. The hard and time-consuming work of onboarding and payments to tournament winners begins after a successful tournament and competition ends.

The driving force behind solving this complex problem was that Han saw that in the prize money disbursement space, there were many solutions that people were using that only dealt with pieces of the entire payment process but didn’t address the entire payment flow and nuances of the esports industry. Time and resources were wasted as companies increased their costs, hiring more people as they scaled to use various third-party and internal solutions to create a payment platform for tournament winners.

For example, there are platforms that can process payments, but they do not handle taxes, or they do not provide easy onboarding or payment transparency for the gamers. As a result, a company needs a third-party accounting firm to handle the tax part of payments while increasing staff resources to provide payment support. A company may then need to hire more people in the league operations and accounting to educate the players on onboarding and providing the proper information to receive their winning. Han saw that you could hodgepodge together a solution, but it was inefficient, costly, time-consuming, and slow. So, Han built a solution to solve the payment problem in esports.

Han then realized that the problem Payment Labs solves in esports can translate to other industries that have many of the same pain points for their payouts to individuals. There are a lot of factors that go into making a payment platform specific to similar niche industries. These factors include simplifying the onboarding, removing the complexities of compliance, and facilitating cross-border issues of getting that money.

Han with his team built a ground-up solution that addressed and solved the esports problem, which was the original platform Prize Payments. The team then broadened the technology platform they built in esports to other synergistic industries, like traditional sports with similar payment problems and next to adjacent verticals. For example, influencers, streamers, and content creators that may be coming from gaming are monetizing in different ways. They have the same pain points, and the issues tackled in esports translate well to these vertical industries.

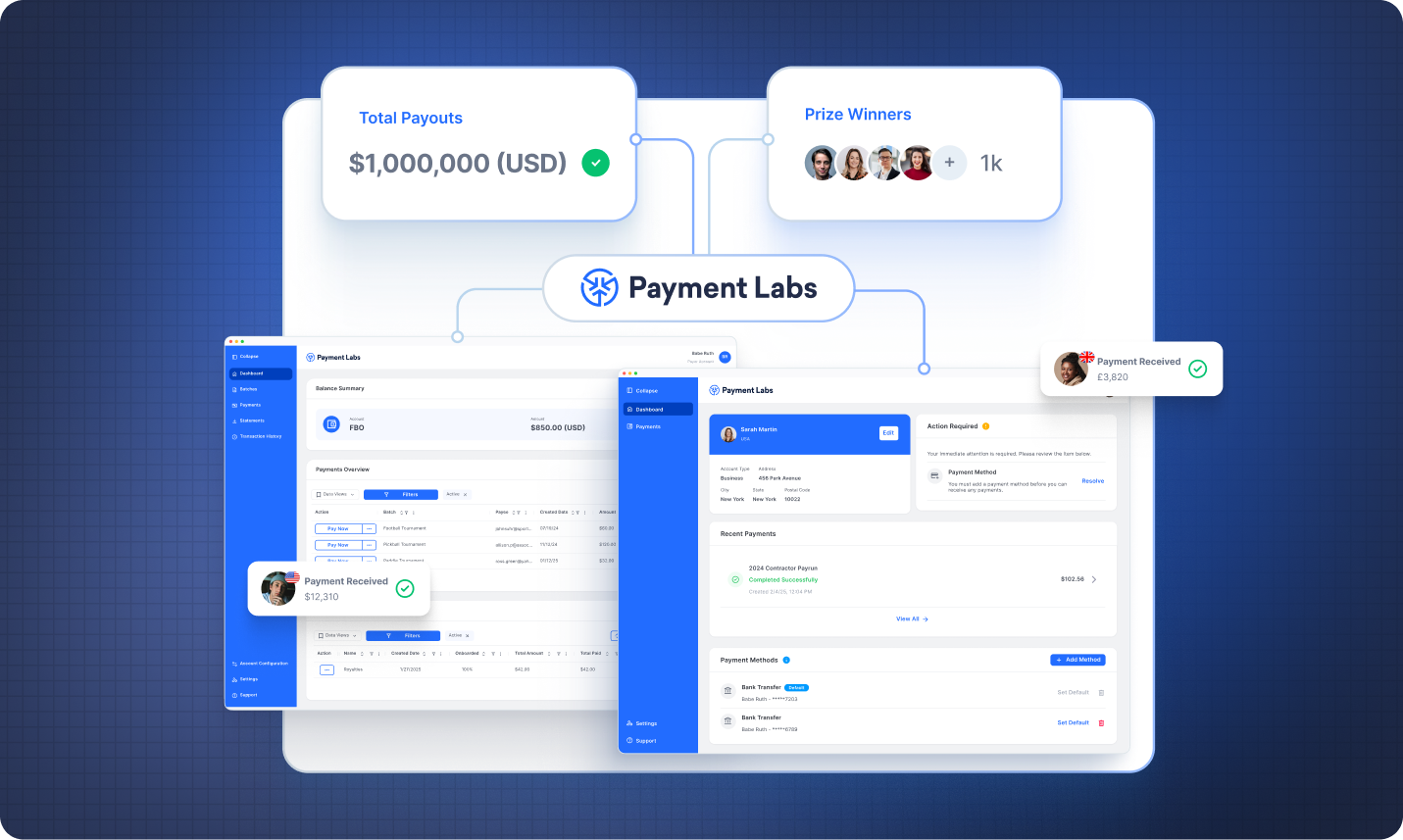

As the Payment Labs solution expanded to handle the pain points of the adjacent and synergistic verticals, it evolved to solve the payment challenges for businesses of any size that need to make payments to an individual anywhere in the world. Now, if any business needs to pay someone worldwide compliantly and efficiently, Payment Labs can make it simple and easy, allowing companies to save time and money related to their accounting, tax, and payment operations.

So, how does Payment Labs save companies time and money?

Han and his team looked at the areas that make payments to people complicated and cost the most time, money, and resources. The concept of paying vendors and other businesses is not new, as businesses have been paying each other for a long time. But most businesses know what it means to get onboarded, how to receive their payments, what net terms are, and what information they need to share with each other’s accounting teams to move invoices and payments. There are a lot of different third-party processing platforms that do it efficiently. They have different payment routes, but it’s designed around businesses paying businesses.

Another easy concept is peer-to-peer, which is a people-to-people payment. These are Venmo, PayPal, and Cash App, where it’s easy and intuitive because there are no complexities of compliance other than transferring funds from one person’s account with a certain amount of dollars to another. You have to balance the two when it’s a business trying to pay an individual because individuals know there are faster ways to get paid because they use peer-to-peer systems. Businesses know they can pay other companies, but it’s harder to pay an individual when they’re not established as an entity where they are structured and can properly onboard and meet the business compliance and accounting requirements to pay them. There’s a payment gap that only a few are trying to tackle, which is what the Payment Labs platform addresses.

With Payment Labs, all a business needs to pay any individual is a verified email address and the amount. The platform does the hard work of onboarding and handles everything else. With a straightforward process, the payee can onboard within 3-5 minutes on the Payment Labs platform and get paid usually within 48 hours or less, depending on the payment method they selected during the onboarding.

The first part of the process for the payee is onboarding. Payment Labs makes it as easy and intuitive as possible for the individual getting paid, like a peer-to-peer system where people sign up and provide the necessary information to create an account to get paid. In a few minutes, the payee is guided to enter their personal information, the payment method they would like to use, and their tax information. The information they provide is verified and validated in real-time to minimize human error.

Additionally, Payment Labs can transact in 140+ currencies across 180 countries using optimized banking network for cross-border payments. A business no longer has to figure out how or use multiple payment platforms to get a payment from their funding currency to their payee in their local currency or their best rate and payment method.

Payment Labs is designed for businesses that need to frequently pay individuals and how that payment flow works the most efficiently. The platform also mitigates the risk for companies on the compliance side, which is not only financial and KYC / AML regulatory requirements but also ensures that proper tax reporting related to the payment, when applicable, is completed. The platform then optimizes the routes so the payor doesn’t have to think about how to pay that person and their payment methods. The highest standards of data security and privacy are also enforced.

The business then funds an FBO (For Benefit Of) account on Payment Labs’ banking network after passing banking compliance requirements, which means the funds are always in their possession. Payment Labs then sends payment instructions for every payment that the business initiates and approves. Once the payee is onboarded, their information is verified, and payment is checked for compliance. Payment Labs handles the back end of optimizing the payment routes and makes sure that the payee receives the money in the currency that they chose as a bank transfer, but they also have the option to select faster prepaid card and push-to-card methods in countries where these methods are available.

People are doing business with each other worldwide in our digital global economy and are no longer restricted by geography. People want faster payments with more access and options. That’s what the Payment Labs platform provides. The Payment Labs solution makes payments more accessible and straightforward, mitigates many security, privacy, and regulatory risks for businesses, and makes it easy for the individuals they pay.

As you address these pain points, businesses can scale more efficiently and conduct business globally, whereas previously, they may have been limited to only doing events or work with content creators in the U.S. because of the payment challenges and compliance issues. These businesses can now expand Internationally without dramatically increasing their costs or expending more internal resources and time. With the Payment Labs platform, they can conduct global events or engage content creators worldwide, which often tends to lower costs dependent on the costs of labor, materials, and services in various countries. In addition to lowering costs, businesses can now efficiently grow and scale their international business and reach. As everything moves towards a global digital economy, everything must be faster and more accessible for a business to scale.

Payment Labs is modernizing the way legacy payments are always done through new banking technologies and software. Payment Labs has moved over $36 million of prize money in 75+ different currencies in 100+ countries to over 20,000 individuals. There isn’t another platform that can do this holistically, compliantly, and efficiently, especially for prize money payouts.

Payment Labs can do more than what other platforms offer and allow any business of any size to pay anyone anywhere in the world. Small and medium-sized businesses looking for an enterprise-grade payment solution that they can afford now also have an option with Payment Labs.

If you want to streamline your payment process, contact our team today!