How prize payments work and how to get them right - an organizer’s guide

Handling prize payments involves more than just calculating who won and how much. Organizers must distribute funds to multiple recipients across different jurisdictions, split prize money between team members, manage currency conversion rates, and comply with tax and regulatory obligations. They also have to meet participants’ expectations for accurate and fast payouts.

For the competitors, the fun part often ends when the tournament does. But for the organizers, that’s when the real challenge begins. Delays, lost payments, missed reporting deadlines, and incorrect amounts can frustrate participants, waste administrative resources, trigger audits, and damage the reputation of a tournament, league, or championship.

How organizers handle payouts directly affects growth. Reliable, fast, and transparent prize payouts build trust with participants, teams, contractors, and partners. Over time, word spreads, winners return, and emerging competitions attract more talent, sponsors, and higher entry fees. Clean payout execution is a competitive advantage that strengthens the brand and creates a network effect as events grow and repeat participation increases.

Full money lifecycle for tournaments

Executing transactions to prize winners is just the tip of the iceberg in tournament money management. From participant registration to final payout and tax reporting, every step of prize money management can create compliance headaches and drain your team’s resources. Here’s what organizers need to handle before, during, and after the event to run payouts efficiently, securely, and compliantly.

Pre-event stage

Before money starts moving, organizers need to make sure that the infrastructure for seamless and compliant collection and distribution of funds is in place.

- Entry fee collection - participants need a reliable and intuitive way to submit their entry fees and track their profile status. Ideally, they need access to a personal dashboard to manage their information.

- Membership management - organizers need to verify that participants meet eligibility requirements and, if needed, manage recurring membership payments.

- Identity verification/KYC - to comply with domestic and international regulations, verify participants’ identities and screen against major sanction and criminal databases.

- Payment methods - tournaments have to offer multiple payment options for deposits and payouts: ACH, wire, debit/credit/prepaid cards, digital wallets, and local methods.

Correct handling of pre-event data collection, verification, and automation can prevent the vast majority of post-event payout issues.

Event stage

Once the competition begins, organizers need the ability to track results and calculate prizes without slow, manual processes.

- Score tracking/Winnings calculation - use clear rules and automated systems to evaluate performance and calculate results quickly.

- Prize splits and adjustments - support team prize-sharing and conditional adjustments.

- Instant and delayed payouts - decide which payments go out immediately and which can be scheduled according to tournament rules.

- Automated and manual payment scheduling - batch reconciliation should be automated, with capacity for manual corrections.

Automated scoring and payout tools reduce errors, lighten administrative burden, and keep participants confident.

Post-payout stage

After payouts are sent, organizers must handle disputes, maintain records, and prepare tax documentation.

- Tax withholding, remittance, reporting - depending on jurisdiction, you need the ability to generate tax documents and remit taxes on time. For example, in the U.S., you have to prepare verified W-8/W-9 forms, withhold taxes from certain payments, and generate 1099/1042 forms for your organization and payees.

- Chargebacks, refunds, disputes - even with automation, mistakes can occur. Be prepared to handle issues with already processed transactions.

- Audit trail and record keeping - maintain detailed logs of all money movements for internal reporting and future reference.

Other considerations

Some prize-related tasks span all stages of the tournament.

- Cross-border compliance - every jurisdiction has its own rules for receiving and sending prize money.

- Currency conversion - poor rate management can reduce funds for both organizers and participants.

- Fraud and risk monitoring - implement proactive measures to detect and prevent suspicious activity during registration, payments, and refunds.

- Reporting and analytics - track payment success rates, participant satisfaction, exchange rates, and other relevant data to improve efficiency for future events.

- Payment support - provide support for failed or lost payments. Ideally, your payment provider should offer support on your behalf.

How to pay tournament winners digitally

Most actions that happen after the event ends are invisible to participants, but they are critical for successful prize payouts.

- Finalize results - the tournament system gathers scores, resolves disputes, and confirms placements. Prize amounts are finalized, and splits are calculated for teams or shared placements.

- Notify winners - once the results are locked, winners’ payment information is used for payouts. It’s important that this process is automated through a secure online system, rather than exchanging forms or bank details via email.

- Ensure regulatory compliance - perform identity verification, sanction and fraud screenings, and tax data checks before releasing funds.

- Execute payments - apply any fees, withholdings, adjustments, and currency conversions to the outgoing transactions.

- Maintain post-payout records - store all transaction data to generate tax documents and maintain a detailed audit trail for future reporting or disputes.

Prize winners can be individuals, groups, or entities across multiple countries, banking systems, and tax jurisdictions. They expect fast, error-free delivery, while staying compliant and tax-ready. While tournaments may run smoothly, the prize payout experience is often where many competitions fail.

Delays and transaction failures usually have two main causes:

- Payment infrastructure - outdated or limited platforms slow or block payouts.

- Winner data issues - event staff may lack required banking or tax information, or the preferred payment method may be unsupported.

Addressing these issues before the event ensures that organizers don’t have to chase missing data after the fact. Proper preparation reduces stress, prevents delays, and ensures a smooth payout experience for all participants.

UX expectations and regulatory reality of prize payments

As a winner, you expect fast access to prize money, minimal paperwork, and clear communication from organizers. But these expectations often clash with regulatory requirements and the capabilities of digital payment infrastructure.

Prize payments are treated differently than consumer transactions. Organizers have to comply with:

- identity verification requirements

- tax residency, and withholding laws

- sanctions and anti-money laundering checks.

This compliance is essential, but creates friction, especially for international payouts.

Figuring out cross-border prize payments

Prize payments are regulated differently by jurisdiction. Local tax laws, reporting thresholds, and other obligations vary, complicating payouts. However, generally, international transactions:

- Have higher failure rates

- Take longer to process

- Cost more

- Require more support.

When working with multiple currencies, it’s important to make sure your payment provider has procedures in place to convert payments at favorable rates, so participants receive the correct amount in their local currency and you don’t overpay.

Another thing to pay attention to with cross-border payouts is the choice of local payment methods which foreign participants may prefer to use. Your payment provider needs to help you meet these expectations and maintain a smooth experience.

How prize payouts are executed

Executing prize payments involves preparing, releasing, routing funds, and handling exceptions. As an organizer, the decisions you make at each step determine how efficient the payout will be.

1. Funding the prize pool

The first consideration is how the prize pool is funded.

- Pre-funded payouts - prize money is set aside in advance and can be released immediately once winners are confirmed.

- On-demand funding - funds are pulled from bank accounts as needed. This approach may be affected by banking cutoffs, settlement windows, and insufficient balances.

This choice impacts cash flow and payout speed, and whether funds are delivered the same day or take longer.

2. Payout timing

Not all payouts can be released at the same time.

- Lower-value prizes can often be processed automatically.

- Higher-value or cross-border prizes may require additional reviews.

The right payment provider helps avoid bottlenecks where a single exception could delay hundreds of winners.

3. Complex prize structures

Team events, shared placements, performance bonuses, and post-event adjustments can complicate execution. When these calculations live in spreadsheets, errors are inevitable and become harder to correct.

Executing prize structure and splits effectively requires tracking each allocation automatically without delaying the entire payout batch.

4. Exception handling

Execution rarely goes perfectly. Bank details change, transfers fail, and recipients can request corrections. Organizers need:

- Structured exception handling to avoid duplicate payouts or leaving winners unpaid.

- Controlled reissues with full traceability, ensuring effortless corrections.

5. Batch reconciliation

Batch payouts require automated processing and real-time visibility into:

- Completed payouts

- Pending payouts

- Failed payouts

This ensures execution does not take weeks and organizers can monitor and correct issues efficiently.

Why prize payments fail

Prize payments rarely fail because the organizers are trying to get out of paying. They fail because the payout process breaks at predictable points, mostly after the event is over and the winners are eagerly anticipating their money.

Typically, delays and failures occur in one of these points

- Banking cutoffs - payments initiated outside processing windows may not move until the next business day or even longer for international transfers.

- Compliance holdups - in some cases winners are flagged after the results are finalized, putting payouts on hold to get additional verification or documentation.

- Data errors - minor data errors can stop a payout. A wrong digit or an unsupported payment method can delay an otherwise ready batch.

- Lost funds - in rare cases, funds are delayed or lost in transit due to intermediary banks or currency conversion issues. Without proper tracking, resolving these cases can take weeks.

Choosing a payment provider for competitions and prize payouts

Generic payment processors are rarely equipped to handle the complexity of tournament payouts. Organizers should look for providers with expertise and features designed specifically for competitions.

- Prize payouts - platforms built for event payouts understand split prizes, pre-funded pools, batch processing, and cross-border complexities of running tournament payments.

- Payins - apart from payouts, it’s important that your payment provider could handle all payments that your organization is going to receive, including fees and memberships.

- User portal - participants need to be able to track payments, access tax documents, and resolve issues without contacting organizers directly.

- Global coverage - tournament organizers need the capacity to support dozens of countries and currencies to ensure payouts succeed regardless of where winners reside.

- Compliance automation - built-in KYC, AML, and tax reporting reduce regulatory risk, and administrative overhead.

- Support - both event staff and participants need to have a direct line with professional payment support provided by qualified experts who can help track payments down and resolve any issues in case a transaction is lost or delayed.

- Flexible payout methods - options including ACH, wire, cards, digital wallets, and local payment methods help organizers meet diverse participant needs.

- Handling refunds and chargebacks - organizers need to be able to handle a number of mistakes or problems with transactions that were already processed.

- Cybersecurity and fraud prevention - the cybersecurity and fraud prevention measures taken by a payment provider have to get updated regularly and adhere to the strictest financial industry standards.

- Tax assistance - automatic withholding, remittance, tax data verification, and reporting help organizers save a ton of time during tax season and avoid costly audits.

- Reporting and analytics - visibility into payment success rates, exceptions, and exchange rates allows organizers to stay on top of their data, see trends, and continuously improve.

How successful events handle prize payments and other payouts

The higher the level of the competition, the wider the geography of participants it reaches. It’s common for tournaments to work with dozens of countries and currencies. Here are just some examples of large-scale events where Payment Labs handles payouts.

- One of the world's biggest esports tournaments paid out $13M+ across 60 countries and 46 currencies.

- The biggest action sports tournament, X Games regularly pays participants in over 30 countries.

- CueSports pays 2700+ athletes across hundreds of tournaments.

- Arnold Sports automates prize payouts from athlete onboarding to tax compliance

- Pickleball association pays out $6M in prize money in 300 tournaments

- The largest fighting game tournament distributes their prize across 55 countries and 43 currencies.

Bottom line

Prize payouts are more than just a transaction. It’s the final touchpoint of your event that shapes how the participants perceive the entire experience. Organizers who plan early, automate processes, and choose the right platform minimize errors, maintain compliance, build trust, and create a foundation for future growth.

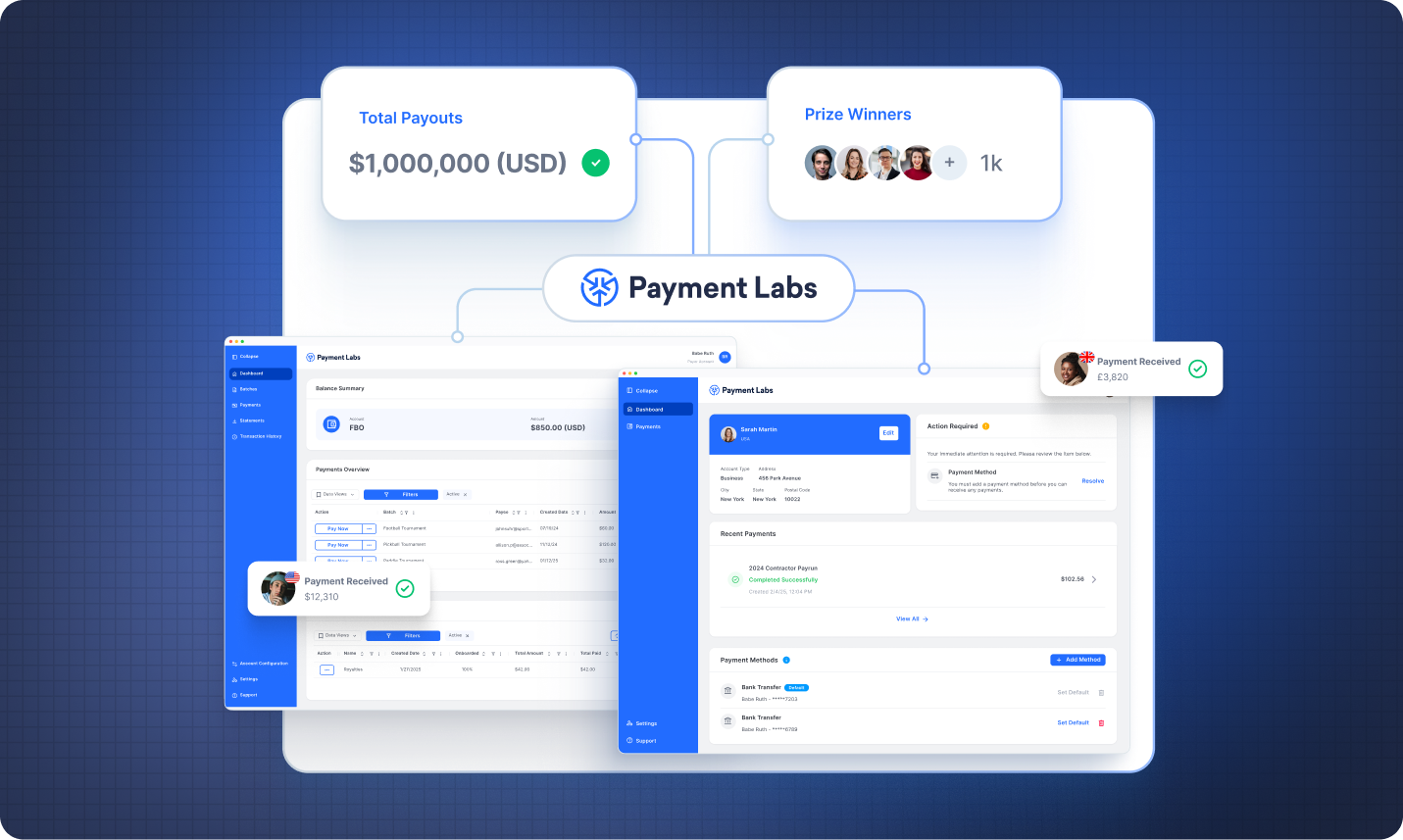

Payment Labs provides an end-to-end financial infrastructure purpose-built for efficient prize money management. Whether you’re running a sports league, a hackathon, or an esports tournament, it helps you deliver prize money as well as process all other payments accurately, securely, and on time, every time.