Generic vs specialized payment infrastructure for global and non-standard business models

Payments feel like a solved problem until the needs of a business expose the limits of a payment provider. At that point, they stop being an invisible utility and start becoming an operational obstacle.

As volume and complexity increase, teams are forced into manual workarounds, global payments get more expensive, settlement slows down, and customers struggle with checkouts and payouts.

Business needs differ and payments for ecommerce are very different from what an esports tournament, a service provider, or a gig economy platform needs. When you pay freelancers, contractors, vendors, tournament winners, or other international payees, the challenge isn’t just payment fees. You have to take care of compliance, tax reporting, reconciling financial data throughout your digital infrastructure, currency exchange, and automating complex payout workflows.

Making the right choice between generic payment providers like Stripe or Square and a purpose-built payment platform for your industry will dictate your operational efficiency, strategic business direction, customer satisfaction, and ultimately your bottom line.

This article examines the trade-offs between generic and specialized payment solutions, helping determine which will support growth, security, and customer experience for your organization best.

Understanding payins and payouts

Your choice of a payment provider is going to define how your organization accepts, moves, and distributes money. At its core, it connects customers, banks, payment rails, and the business to ensure funds are authorized, transferred, and settled efficiently, quickly, and compliantly.

There are two sides to the flow of funds in a business - payins and payouts.

Accepting payments (payins)

Payins are all the ways revenue comes into a business. The system needs to be capable of automatic reconciliation, flexible fee management, and support for complex billing logic including subscription, usage-based, or hybrid models.

A modern payin infrastructure ensures funds move efficiently and quickly across currencies, minimizes manual work, and makes incoming transactions reliable, easy to track, and scalable. Business owners looking for providers that will help them to:

- Accept payments from a variety of payment methods

- Prevent fraud and safely authorize transactions without manual reviews

- Automatically settle funds into the correct business accounts

- Simplify management of refunds, chargebacks, and disputes

- Configure fees and custom payment structures intuitively

- Maintain regulatory and tax compliance without added administrative burden

- Optimize customer experience during onboarding and at checkout.

Sending payments (payouts)

Payouts are often more sophisticated than receiving payments. This process involves sending money to numerous recipients based on internal rules, handling currency exchange, schedules, banking systems, and regulatory requirements while providing both the team and the payees with full visibility into transaction status and history.

Inefficient payouts mean delays, errors, and hours reconciling payments, gathering data for reporting, and supporting payees with transaction issues. The key parts of payout automation include:

- Routing funds to the correct recipients

- Supporting multiple payout methods and schedules

- Automating tax handling and compliance requirements

- Detailed reporting and automatic reconciliation

- Configurable fees, commissions, and deductions

- Multi-currency and cross-border payments

- Integration with ERP, CRM, HR, accounting, and billing systems

- Audit trails for regulatory compliance

- Role-based access and permission controls

- Payee self-service portal.

You can learn how payouts work in detail in our guide.

Financial infrastructure beyond payins and payouts

While payins and payouts are the core of revenue movement, a payment infrastructure needs to support financial workflows end-to-end. The key areas to consider when choosing a provider include:

- Payment orchestration - combining multiple payment methods, routing rules, schedules, conditional workflows across departments, regions, and business units.

- Operational efficiency - integrating seamlessly with ERP, CRM, accounting, and other systems to centralize transaction data and provide teams with clarity, transparency, and functionality where and when they need it.

- Risk, compliance, and tax automation - ensuring the business can handle multi-jurisdictional tax reporting, KYC/AML compliance, and audit readiness without manual intervention.

- Scalability and flexibility - supporting shifting business models, global operations, hybrid billing, and multi-party revenue flows.

- Customer/payee experience - maintaining frictionless onboarding, simplified tax and user data management.

- Security and resilience - preventing fraud, maintaining high standards of cybersecurity and operational continuity.

What happens when the payment provider is wrong for you

Once multiple currencies, payment methods, workflows, tax, and regulatory frameworks appear, generic providers like PayPal, Stripe, or Square fall short because they are built for broad adoption, not the nuance of particular business models or international operations.

When you outgrow a payment provider, the impact is felt across the organization. Staff spend hours reconciling transactions or tracking down rejected payments, tax reporting becomes an operational burden, and customers don’t convert due to confusion or high fees. Costs increase, errors multiply, and growth slows.

At that point, a business has to decide whether to shape their processes around the simplistic platform’s capabilities or move to a specialized infrastructure purpose-built to support workflows, scale, and reach of their industry and business model.

Generic vs specialized payment infrastructure

Most companies start their payment provider search with a one-size-fits-all solution, which works fine as long as you can handle every payment manually, don’t mind tracking everything in spreadsheets, operate domestically, and don’t think about the unavoidable tax season. But as a business grows, generic providers become a constant drain on resources, forcing you to build around rigid tools, surprising you with fees, and pricing tier shifts.

Specialized payment infrastructure, by contrast, is built to support your business model, operational scale, and international ambition. It automates reconciliation of payment data, accommodates flexible payin and payout flows, ensures compliance across jurisdictions, and integrates with your existing digital infrastructure.

The limitations of one-size-fits-all payment providers

As your needs evolve to require flexible pricing, new payout models, tax preparation support, and international capabilities, a business is forced into increasingly costly and time-consuming workarounds. Clients grow frustrated navigating confusing payment portals, while your team wastes hours reconciling transactions across multiple systems. Businesses looking to switch from generic providers mention these problems most often:

- Limited payment details configuration (e.g. recurring payments, flexible terms, fees)

- High transaction costs

- Lack of specialized support

- Limited integrations with business systems

- Poor international coverage

- Compliance challenges.

When generic payment providers are a good fit

Generic payment partners like Stripe, PayPal, or Square work well for businesses with straightforward, standardized payment needs.

- Simple ecommerce offering that doesn’t require transaction variety

- Domestic operations, no multi-currency transactions

- Integration with other systems is not critical

- No compliance or tax automation required.

When a specialized payment infrastructure is a good fit

Moving beyond a generic payment provider gives you a solution tailored to your industry, with intimate knowledge of the type of work you do, the services you offer, and the way you run your business. Rather than having to fit the capabilities of a one-size-fits-all payment platform, you can benefit from a focused product development approach that prioritizes the needs of your business.

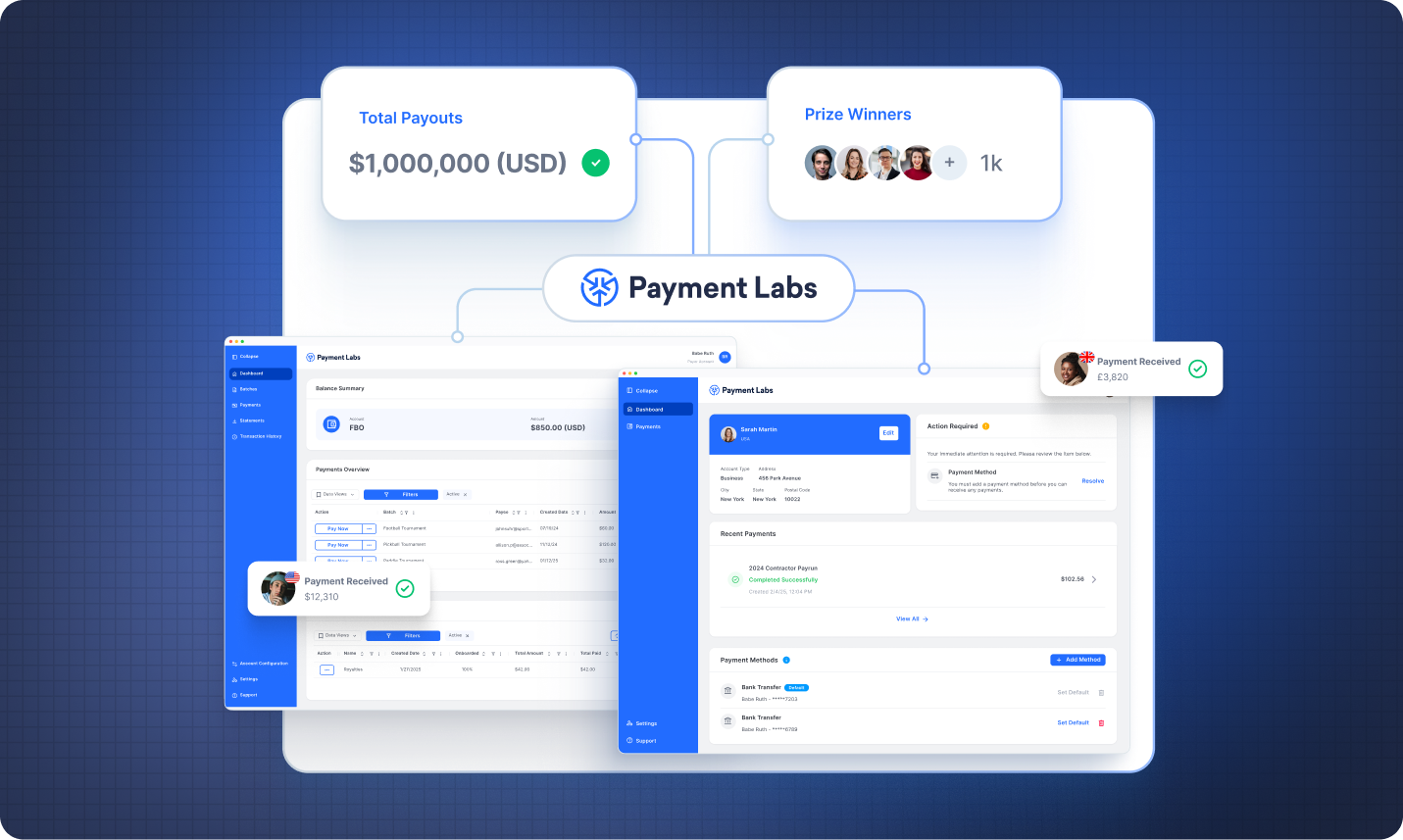

For example, Payment Labs specializes in non-standard payment projects, including tournaments, leagues, gig economy, royalties, and other business models with high transaction volume, complex payout flows, and custom fee structures.

Organizations that opt for specialized payment providers often look for:

- Global payouts to contractors, vendors, or partners

- Built-in compliance with tax and regulatory requirements

- Flexible payin and payout flows (recurring, usage-based, hybrid billing models, revenue splits, commissions, royalties, etc)

- Automated reconciliation and real-time reporting

- Integration with other business systems

- Audit trails with role-based permissions

- Capacity to handle high transaction volumes without manual overhead

- Adaptation to evolving business models and new markets.

Questions to ask potential payment providers

As a business, you need fast, reliable payins and payouts, reduced compliance risks, minimal operational overhead, low payment cost, and high-quality customer support. When evaluating a payment provider, these are key questions to ask:

- Can you pay people anywhere in their local currencies without overpaying on foreign currency exchange fees?

- Does the provider handle collection and verification of personal data for tax purposes? For example, in the U.S., can it verify personal data, generate W-8/W-9 forms, produce 1099 and 1042 forms, and handle tax withholding?

- How flexible are payouts? Do they support bank transfers, wallets, international payment rails, credit and debit cards?

- Can the provider handle both payins and payouts?

- Will it automate reconciliation and reduce administrative burden or will additional staff be required to manage finances?

- Can the provider handle the anticipated transaction volume, and how will this impact pricing?

- Will you have pre-configured access to the payment options your target audience expects?

- What is the migration process, and how long does it typically take?

- What data security and anti-fraud measures are in place?

- What features or support does the provider offer to improve the client or payee experience?

How to choose a payment provider - checklist

Choosing a payment provider isn’t about features in isolation. It’s about how well the system supports all aspects of your business. Use this checklist to determine a long-term fit.

- Tax and regulatory compliance - managing payee tax forms and preparing your own filing manually can drain resources. Your provider should automate tax withholding, form collection, and end‑of‑year reporting. Pre-configured Know Your Customer(KYC) and Anti-Money Laundering (AML) processes are critical for global payouts as well.

- Transaction fees and pricing structure - many payment providers add hidden fees or sudden pricing tier changes to your contract. Flat rates often suit small- to mid-size businesses, while high-volume businesses may prefer an interchange-plus model for cost transparency at scale.

- Payment methods - customers and payees expect choice. Look for support for bank-based payments, cards, local payment networks, digital wallets, or alternative methods common in your industry.

- Ease of integration and API support - you need to start using the payment provider quickly and integrate their functionality with your existing business infrastructure.

- Settlement speed vs transaction cost - settlement speed and cost depend on the payment rail selection or an alternative structure, like FBO accounts.

- Scalability - your provider must be ready to handle growing translation volumes, complex billing, and tax reporting without creating bottlenecks.

- Cybersecurity - look for SOC 2 Type II, PCI DSS, GDPR compliance, end-to-end encryption, multi-factor authentication, and AML/KYC controls.

- Coverage - even if you don’t need to make or receive cross-border payments or don’t consider a specific jurisdiction, don’t limit your options. Compliant and cost-effective international payments for business should always be within reach.

- Deployment - modern providers should deploy fully operational infrastructure within days or weeks, not months, even for deep integrations and customization.

- Onboarding and operational simplicity - Staff, management, and customers should be able to start using the new solution out of the box without much additional training.

- User experience - many businesses stop at evaluating the usability of the payment provider for the team and disregard how user-friendly and intuitive the solution is for their clients and payees. A streamlined onboarding process, and a dedicated workplace with clear settings and relevant options go a long way when it comes to customer retention.

- Transparency - hidden fees and surprise charges undermine trust. Make sure the provider’s pricing is clear and predictable.

- Custom payment types - ensure the capacity to handle industry-specific models like revenue splits, commissions, royalties, multi-party payments, recurring, usage-based payments, rules-based routing and settlements.

- Reputation and relevant expertise - the provider should have experience in your industry, ensuring they can manage specialized compliance, tax, and operational needs.

- Expert support - access to professional support 24/7 for both your team and your clients or payees is critical for smooth operations.

Why Payment Labs

Payment Labs is built for businesses that outgrow one-size-fits-all payment providers. Its purpose-built infrastructure handles complex payins, payouts, global operations, and high transaction volumes without manual workarounds or administrative overhead.

Unlike generic platforms, Payment Labs adapts to your business logic, supporting flexible fee structures, multi-party payouts, and industry-specific workflows, while automating reconciliation, tax handling, compliance, and reporting.

Payment Labs is trusted by leading organizations operating in complex, non-standard payment environments. With 24/7 support, the platform ensures compliance, flexibility, transparency, and reliability.

The solution offers coverage in 180+ countries and 150+ currencies. Teams get full visibility and control, payees get a dedicated dashboard with all the data and functionality they need, enabling operations to scale efficiently without expanding headcount.